In May, \(750\) of the Blue Jay models were sold as shown on the contribution margin income statement. When comparing the two statements, take note of what changed and what invoice templates for free remained the same from April to May. For example, assume that the students are going to lease vans from their university’s motor pool to drive to their conference.

How to Calculate Contribution Margin

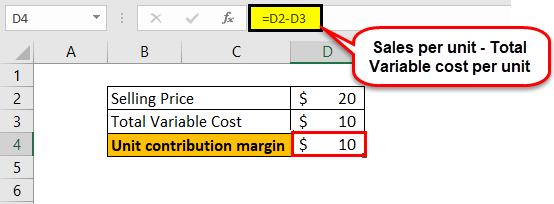

This cost of the machine represents a fixed cost (and not a variable cost) as its charges do not increase based on the units produced. Such fixed costs are not considered in the contribution margin calculations. The contribution margin is computed as the selling price per unit, minus the variable cost per unit. Also known as dollar contribution per unit, the measure indicates how a particular product contributes to the overall profit of the company. Recall that Building Blocks of Managerial Accounting explained the characteristics of fixed and variable costs and introduced the basics of cost behavior. The company will use this “margin” to cover fixed expenses and hopefully to provide a profit.

How do you calculate the weighted average contribution margin?

Generated profit is the amount of money that remains after all costs, both variable and fixed, have been paid. The relationship between Contribution Margin, sales, and profit is crucial in understanding this. Understanding the contribution margin of your products or services can guide critical decisions such as pricing, product mix, and cost management.

Create a Free Account and Ask Any Financial Question

However, a general rule of thumb is that a Contribution Margin above 20% is considered good, while anything below 10% is considered to be relatively low. Take your learning and productivity to the next level with our Premium Templates. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

- Jump, Inc. is a sports footwear startup which currently sells just one shoe brand, A.

- It represents how much money can be generated by each unit of a product after deducting the variable costs and, as a consequence, allows for an estimation of the profitability of a product.

- In particular, the use-case of the contribution margin is most practical for companies in setting prices on their products and services appropriately to optimize their revenue growth and profitability potential.

Fixed costs — such as rent, insurance and salaried employees — remain constant regardless of how much a business produces or sells. Also, it is important to note that a high proportion of variable costs relative to fixed costs, typically means that a business can operate with a relatively low contribution margin. In contrast, high fixed costs relative to variable costs tend to require a business to generate a high contribution margin in order to sustain successful operations.

The Evolution of Cost-Volume-Profit Relationships

It helps in identifying which products are more profitable and which might be draining resources, enabling more informed strategic decisions. Contributions margin ratio (also known as gross profit ratio) is one of the most important financial ratios. It measures how profitable a company is with each dollar of sales revenue. The overarching objective of calculating the contribution margin is to figure out how to improve operating efficiency by lowering each product’s variable costs, which collectively contributes to higher profitability.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making. We will discuss how to use the concepts of fixed and variable costs and their relationship to profit to determine the sales needed to break even or to reach a desired profit. You will also learn how to plan for changes in selling price or costs, whether a single product, multiple products, or services are involved.

One way to express it is on a per-unit basis, such as standard price (SP) per unit less variable cost per unit. Yes, it means there is more money left over after paying variable costs for paying fixed costs and eventually contributing to profits. Now, add up all the variable costs directly involved in producing the cupcakes (flour, butter, eggs, sugar, milk, etc). Leave out the fixed costs (labor, electricity, machinery, utensils, etc). Contribution margin ratio equals contribution margin per unit as a percentage of price or total contribution margin TCM expressed as a percentage of sales S. To calculate the contribution margin, we must deduct the variable cost per unit from the price per unit.

A contribution margin ratio of 40% means that 40% of the revenue earned by Company X is available for the recovery of fixed costs and to contribute to profit. Here, the variable costs per unit refer to all those costs incurred by the company while producing the product. These include variable manufacturing, selling, and general and administrative costs as well—for example, raw materials, labor & electricity bills. Variable costs are those costs that change as and when there is a change in the sale. An increase of 10 % in sales results in an increase of 10% in variable costs. To calculate the contribution margin, subtract the product of the variable costs times the number of units sold from the product of the selling price times the number of units sold.